North Korea is set to triple the number of its troops fighting for Russia along the front lines with Ukraine, sending an additional 25,000 to 30,000 soldiers to assist Moscow, according to an intelligence assessment from Ukrainian officials.

The assessment also says there are signs that Russian military aircraft are being refitted to carry personnel, reflecting the vast undertaking of moving tens of thousands of foreign troops across Russian Siberia, which shares a border with North Korea in its far southwest.

North Korea initially sent 11,000 troops to Russia in the fall of 2024 in great secrecy, with Russian President Vladimir Putin only confirming the deployment in late April.

In October, North Korean soldiers were pictured being handed equipment for the frontlines at the Sergeevka military base in Primorskyi Krai.

A month later, a Ropucha-class Russian ship docked at the Dunai port near Nakhodka, 95 kilometers (59 miles) to the southwest, which could carry up to 400 troops, analysts said.

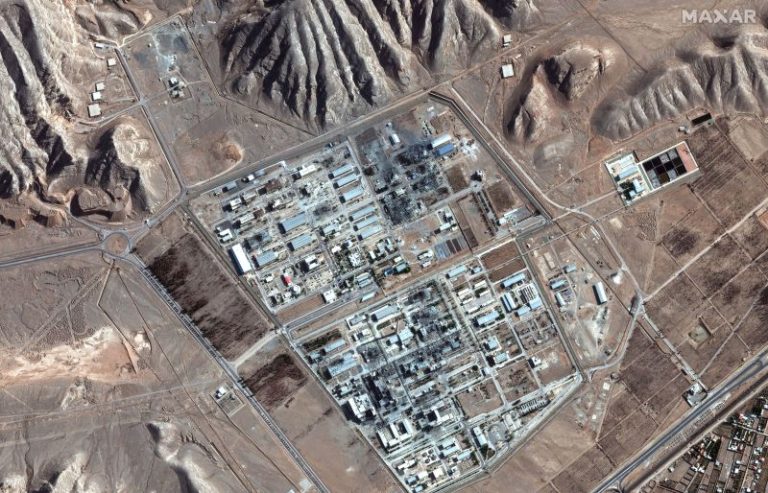

“Satellite imagery shows a Russian personnel carrier arriving at Dunai in May, and activity at Sunan airport in May and June,” said Joe Byrne, senior analyst at the Open Source Centre. “This appears to indicate the routes previously used to move DPRK troops are active, and could be used in any large-scale future transfer of personnel.”

Jenny Town, senior fellow and director of the Korean program at the Stimson Center, said the Ukrainian assessment of up to 30,000 sounded “high… but they can certainly come up with that number. They won’t be elite soldiers. Kim Jong Un has said he is all in, so it depends on what Russia has asked for.”

Town said 10,000 to 20,000 “sounds more realistic,” and that North Korea might slowly deploy the troops in stages. “There have been rumors that Russian generals have been inside North Korea training troops there already,” she said.

Ukraine’s Defense Minister Rustem Umerov said Thursday that Kyiv suspected further North Korean troops might be deployed but added that the country’s leader, Kim Jong Un, risked putting his own government in peril by exposing so many elite troops to the high casualty rates of the front line. “Russia’s use of elite North Korean troops demonstrates not only a growing reliance on totalitarian regimes but also serious problems with its mobilization reserve,” Umerov said. “Together with our partners, we are monitoring these threats and will respond accordingly.”

On Friday, Ukraine’s military chief, Oleksandr Syrskyi, said Russia was amassing 110,000 troops near the front-line hotspot town of Pokrovsk, in preparation for a possible offensive on the strategic population center.

Sergei Shoigu, a top adviser to Putin who previously served as his defense minister, visited Pyongyang on June 17 – a trip made on Putin’s orders, and his second visit in a fortnight, the Russian state-run TASS news agency reported. During the visit, Shoigu announced 1,000 North Korean sappers and 5,000 military construction workers would be sent to Russia, to clear mines and “restore infrastructure destroyed by the occupiers” in the Kursk region, according to TASS.

South Korea’s National Intelligence Service (NIS) has briefed lawmakers in Seoul that North Korea has begun selecting personnel for overseas deployment which could occur as early as July or August, according to remarks by lawmaker Lee Seong-kweun. He highlighted Russia’s public announcement of another 6,000 North Korean mine clearers and military construction workers being sent. It is unclear if the NIS shares the Ukranian intelligence assessment that the deployment could be as many as 30,000.

The six-minute video shows a Russian military instructor declaring that North Koreans aged 23 to 27 arrive “physically well-prepared.” He added, “As fighters they are not worse than ours. The enemy runs away first.”

The Russian trainer discusses with Kim a translation sheet of basic military Russian terms to Korean. It is unclear if the North Korean trainees are new arrivals or the remnants of the 11,000 sent last year. The reporter also visits a trench network where the North Koreans live with basic comfort items such as red Korean pepper, and handwritten posters declaring in Korean “Revenge for our fallen comrades” above their bunks.

Another two videos posted by TASS imply greater integration of North Korean soldiers into the Russian military than was previously seen. North Korean troops’ first exposure to the front line in Kursk was as a distinct, separate unit, owing to the language barrier with Moscow’s troops, according to assessments by Ukrainian officials.

One TASS video shows North Korean and Russian troops working to clear buildings together in close-combat training, and another shows North Koreans receiving training with shotguns, used to tackle the Ukrainian drone threat.

The manuals have emerged at the same time as increasing numbers of videos of North Korean artillery at the front line have been seen online, and as a report from 11 UN member states last month said that Pyongyang had sent at least 100 ballistic missiles and 9 million artillery shells to Russia in 2024.

The report also echoed statements from the South Korean military in March that another 3,000 North Korean troops had been sent to Russia early this year.

Town, from the Stimson Center, said Pyongyang saw a long-term benefit to Moscow being in its debt. “The more ‘blood debt’ there is between them,” she said, “the more North Korea will benefit in the long run, even if they are making sacrifices in the short term.”